The California 1% down payment Conventional Equity Boost mortgage program is designed to help homebuyers with good credit and moderate income overcome their lack of down payment and qualify for affordable financing.

The California 1% down payment Conventional Equity Boost mortgage program is designed to help homebuyers with good credit and moderate income overcome their lack of down payment and qualify for affordable financing.

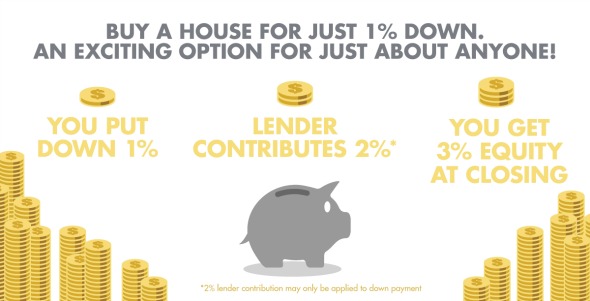

The Conventional 1% down mortgage uses either the Freddie Mac HomePossible Advantage loan or Fannie Mae’s HomeReady loan, with additional qualifying criteria, that only requires a buyer contribute 1% down payment and then they receive a 2% grant (grant capped at $5,000) from the lender.

This is a lender paid down payment program where the actual bank provides a 2% grant to help you meet your minimum down payment requirement. Contact me for more info or just apply now.

BUYING HAS NEVER BEEN SO EASY: You bring in your 1% down payment, the lender contributes an additional 2% down payment (up to $5,000) in the form of a grant (never has to be repaid), for a combined total of 3% down and a 97% LTV!

1% Down Program Highlights

- Conventional 30 year fixed loan

- Down payment can be gifted from a family member

- 2% Equity Boost grant for down payment (grant capped at $5,000)

- Reduced monthly PMI premiums

- Option to avoid paying monthly paid mortgage insurance

- Close in 30 days or less

Eligibility & Qualifying Criteria:

- DO NOT have to be first time homebuyers

- Minimum 720 FICO credit score

- Maximum DTI ratio determined by DU/LP

- Max Loan amount of$417,000 or less

- SFR, 1 unit, owner occupied only (no manufactured)

- Non-Occupant co-borrowers not allowed

- Borrower(s) cannot have ownership in any other property

- Credit Smart homebuyer education class required if first time homebuyer (free)

Qualifying Income Limits

Southern California Income Limits 140% of the area median income (AMI) limit.

==> Search here for all income areas by property address to get the most accurate results.

Income limits are set by census tract and address, not by the county. You would be surprised at how many census tracts in areas you may consider ‘wealthy’ areas have no income limit or the income cap is much higher than you would expect.

No Income Limit ==> When buying in an ‘underserved’ census tract area, there is no income limit or cap.

FYI…..Income from a non-borrowing spouse does not count when determining program eligibility and income cap limit.

How To Apply for the 1% Down Payment Loan

I strongly encourage you to become an informed buyer, learn about all the options that most lenders don’t tell you about, then compare to see which one will benefit you the most, and then take action to secure your preapproval!

The best way to begin learn about your options and eligibility is to answer a few questions here or feel free to contact me here.

No comments yet.