The CityLIFT Down Payment Assistance (DPA) program provides $15,000 to eligible home buyers for Inland Empire’s Riverside County cities of Corona, Riverside, Moreno Valley, and San Bernadino County cities of Fontana and San Bernardino.

The $15,000 CityLIFT funds are actually a ‘soft second’ mortgage which are then forgiven (free money) after the borrower has occupied the home for 5 years as their primary residence. The CityLIFT loan is forgiven at a rate of 20% per year if buyer moves out, transfer ownership, or sells before the 5 year period. Mountain West Financial is a CityLIFT approved mortgage lender (and myself) through Neighborhood Housing Services of the Inland Empire (NHSIE), Neighborworks of America, and Wells Fargo. Lenders must be CityLIFT approved.

Mountain West Financial is a CityLIFT approved mortgage lender (and myself) through Neighborhood Housing Services of the Inland Empire (NHSIE), Neighborworks of America, and Wells Fargo. Lenders must be CityLIFT approved.

CityLIFT Funds are still available! Contact me to check eligibility & qualify

CityLIFT Eligibility & Highlights

- Provides $15,000 in down payment assistance money

- NOT LIMITED to first time home buyers

- Attend an 8 hour CityLIFT Homebuyer education class

- No maximum purchase price. Loan limits must meet FHA & Conventional limits

- For Corona, Riverside, Moreno Valley, Fontana, or San Bernardino only

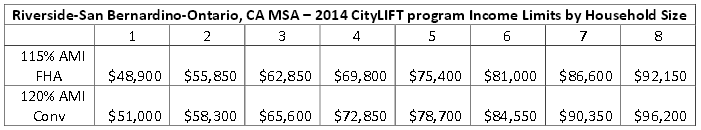

- Total Household income cannot exceed the AMI (see chart below)

- Must meet qualifying criteria for either an FHA or Conventional loan

- $15,000 is forgiven after 5 years of primary residence occupancy

- Borrower cannot own or be on title of another home at time of closing

- Eligible properties include SFR’s, PUD’s, Condo, Townhomes, Manufactured homes (no Wells Fargo REO’s)

CityLIFT Household Income Limits

Additional Financial Restrictions

Borrowers may be required to make an additional down payment contribution if you have ‘too much’ liquid funds in a checking, savings, or money market account. Click the link below for details.

Read details about other financial restrictions here.

You may be required to make an additional down payment contribution from your own funds if your ‘remaining liquid assets’ at the time of settlement will exceed the greater of 6 months of your new housing PITI (principal, interest, taxes, and insurance) payment or $7,500 plus any additional payment reserve requirements that may be imposed by the first mortgage loan program.

‘Remaining liquid assets’ are defined as your available funds in bank accounts such as checking, savings or money market accounts that are readily accessible without withdrawal restrictions or penalties after you have met any out-of-pocket settlement requirements from your own funds.

Liquid assets do not include Retirement Accounts (such as 401(k), IRA or pension accounts), Investment Accounts (such as stock, bond or mutual funds), Certificates of Deposit (CDs), Business Checking or Savings Accounts.

Liquid asset determinations and contribution requirement estimates are made at the time of the first mortgage loan application. Liquid asset funds that are subsequently transferred to restricted accounts after first mortgage application will not be excluded from contribution calculation requirements.

Get Qualified for CityLIFT and/or Learn About Other Home Buyer Assistance Programs

Contact me here or call (951) 215-6119 to learn more about qualifying for the CityLIFT down payment assistance program and get qualified.

No comments yet.