The California Dream for All homebuyer assistance program is a shared appreciation down payment assistance program that provides 20% down payment of assistance, in the form of a silent second loan, to qualified FIRST TIME GENERATIONAL HOMEBUYERS (not just first time buyers). Assistance can be used to pay down payment and/or closing costs.

The California Dream for All homebuyer assistance program is a shared appreciation down payment assistance program that provides 20% down payment of assistance, in the form of a silent second loan, to qualified FIRST TIME GENERATIONAL HOMEBUYERS (not just first time buyers). Assistance can be used to pay down payment and/or closing costs.

The Dream For All home loan and assistance program is another example of how the state of California is helping lower income or disadvantaged residents gain equitable access to affordable financing, to increase homeownership, and create generational wealth.

*Article updated on 3/04/2024

Phase 1 of the Dream For All Shared Equity Assistance Program was a success, helping 2,182 first time buyer families become homeowners and 55% self identifying as belonging to a community of color. View infographic here. The DFA fund homebuyer assistance program is not a handout or a subsidy that will be a burden on the California tax payer because it will be self sustaining from the returns on the shared equity.

Benefits of the California Dream For All Assistance Program:

- Lower interest rate than other assistance programs

- Lower monthly payment because you avoid paying private mortgage insurance(PMI)

- Lower monthly payment due to lower loan amount

- Increased buying power due to larger down payment and lower rate & payment

- No monthly repayment of the subordinate silent 2nd assistance loan

- Homeowner doesn’t repay until they sell, refinance or transfer the property

Repayment of the Dream For All Assistance Loan

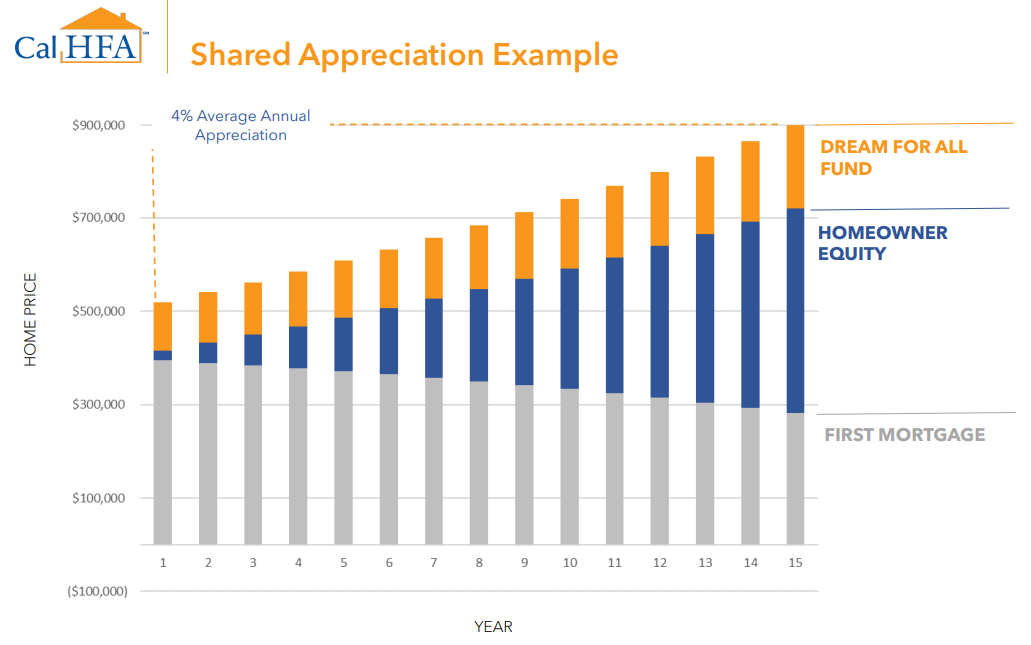

Upon sale, transfer of the home, or if the borrower refinances, the homebuyer will repay the original down payment loan, plus a share or percentage of the home appreciation. The silent second DFA loan does not accrue interest…..it is 0%.

Ability to Refinance

You will be able to refinance and re-subordinate the DFA shared appreciation loan in order to reduce your interest rate and payment just ONE TIME without being required to repay the DFA loan.

What does Shared Appreciation Mean?

It’s not a bad thing. Shared appreciation just means that since the California State Housing Finance Agency is investing (partnering) in your ability to purchase a home that will build generational wealth for you, that you will split or share a small percentage of the increase in the value of the home when you sell, transfer ownership, or refinance.

How Much Appreciation is ‘Split or ‘Shared’?

The percentage of appreciation that is split or shared with the state housing authority when you sell, refinance or transfer your home depends on what your income is.

80%/20% Split = Borrowers with income between 80% to 150% of the AMI (moderate income) keep 80% of the home appreciation. The state receives 20%.

85%/15% Split = Borrowers with income under 80% AMI. (This is almost no one) keep 85% of the home appreciation. The state receives 15%. Search AMI income here.

** Shared Appreciation Cap = Appreciation is capped at 2.5 times the original principle loan amount.

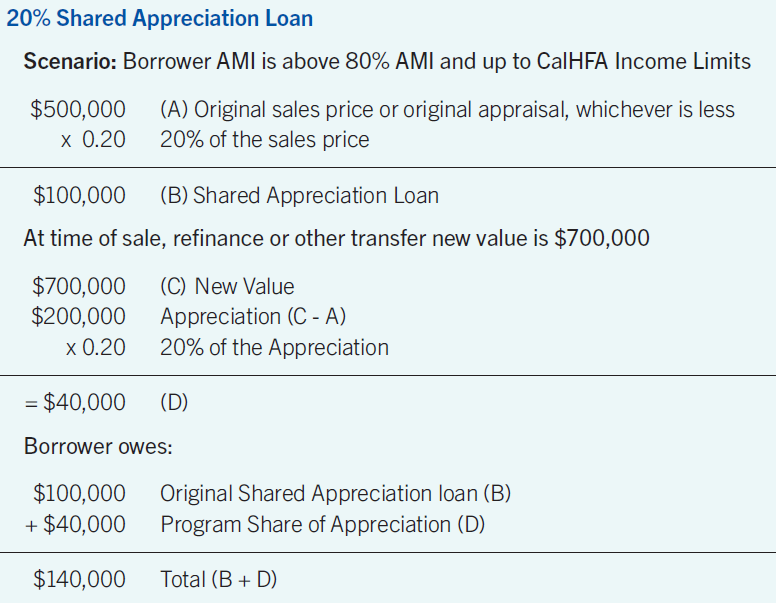

Below is what a $500,000 purchase might look like if a moderate income (AMI 80-150%) homeowners sells their home for $700,000 or refinances and it appraises for $700K.

Dream For All Eligibility & Qualifying Criteria:

- At least one borrower must be a First Time Generation Homebuyer. This means you cannot have owned a home in the last 7 years and your parents cannot have any current ownership in a home or ownership in a home at the time of their death.

- At least one borrower must be a California resident

- Minimum Credit Score & DTI ratio:

- 45% DTI with 680 – 699 FICO score

- 50% DTI with 700+ FICO score

- 45% DTI with 660 up FICO score (income below 80% AMI)

- Property Type: SFR / Condo / Manufactured

- Minimum CLTV: 95% (cannot put more than 5% of your own funds towards additional down payment)

- Non-occupied co-signers not allowed

- Cannot Exceed County Income Limit

- Two step CalHFA homebuyer education course required

- One year home warranty required

- Must be used with CalHFA DFA Conventional 1st loan

- Cannot be combined with other CalPLUS ZIP or MyHome Assistance programs

Frequently Asked Questions (FAQ’s)

How do you verify an applicant is a first time generational buyer?

– Your lender and CalHFA will conduct an audit and verification process and may ask applicants to provide additional documentation to confirm you are a first time generational buyer. Applicants will be required to attest to this under penalty of perjury to avoid fraudulent activities.

When will the DFA portal open?

– Portal will open April 3 and close on April 29th, 2024. Get you pre-approval now!

How long will I have to shop for a home once awarded a Dream For All registration voucher?

– 90 days

Do I have to make payments on the 20% silent second DFA loan?

– No, payments are deferred for the life of the loan (30 years) and the interest rate is 0%.

Can I combine other assistance programs with the Dream For All Shared Appreciation Loan program?

– Yes, but they have to comply with Fannie Mae Community Second guidelines and subordinate to the Shared Appreciation loan. Problem is not many programs willing to do that.

Can the Dream For All Shared Appreciation Assistance loan be used for both down payment and closing costs?

– Yes

What happens if my home does not appreciate in value or actually goes down in value?

– If the home value goes down or does not appreciate by the time you sell, then nothing happens because there is no appreciation to split or share. That is the risk the state of California is taking by partnering with you in this Dream For All homebuyer program. It’s important to know that regardless if the home appreciates in value or even goes down when you sell, the 20% silent second dream appreciation loan will be due and payable.

Can I move out and convert the home to an investment or rental property?

– No. CalHFA will require you pay the Dream For All Shared Appreciation loan off when you move out.

Get the Facts & Know Your Options

Do you have questions like this?

– Are there other homebuyer assistance options you should consider?

– Which assistance program is the best?

– Which program provides the lowest rate and/or lowest payment?

– Which assistance program will help you qualify for more?

This is what I do. I help you figure all this out AND get you preapproved for the homebuyer assistance program that you think is best for you.

Most lenders you speak to have no clue what assistance programs are available to you and/or they are unable to offer them to you. Most loan officers simply don’t have the resources, experience, or knowledge to answer these questions with certainty. In fact, many of them will lie to you and claim you aren’t eligible or will do everything in their power to make an assistance program appear to be of the devil.

How to Apply for the Dream For All Assistance Program

If you would like to get preapproved to learn about which home loan or homebuyer assistance program will benefit you the most, fill out this Down Payment Assistance Prequal Form.

Great post, love the part about being able to refi once without have to repay the DFA loan back!

You mention a “75%/15%” split. Do you mean 85%/15%?

Thanks for a great explanation!

Thank you Robert. That was my typo, yes it is actually a 85/15% split.

Hi Brad,

I notice you post this in Dec 2022, were you able to get many clients in the program and in what neighborhoods did you close using Dreams for All funds?

Hello Gwen. Of the 400 Dream For All applicants, only one buyer of ours was able to get their offer to purchase accepted in time to reserve funds before all funds were depleted in the first 10 days. It was a great program. I hope they are able to come out with a more permanent option to this our the 10% down Equity Builder program.