President Obama announced the Making Homeownership More Accessible and Sustainable directive that requires the Federal Housing Administration to reduce it’s FHA monthly paid Mortgage Insurance Premium (MIP) by .5%. HUD Press Release Mortgagee Letter 2015-01

By reducing the FHA MIP, the Government is making FHA financing more affordable with the goal of boosting homeownership to normal levels around 69%. The current level of homeownership has fallen to 64%, it’s lowest levels since 1995.

FHA’s current annual Mortgage Insurance Premium is 1.35% and will now be .85% starting January 26th. This reduction has the same effect as if mortgage rates had magically dropped .5% overnight.

The average homebuyer in Riverside County, CA will save about $1,500/year from the reduced FHA MI Premiums.

How Much Will Lowering the FHA Insurance Premium Help You?

On a $300,000 loan balance, reducing the FHA annual MIP from 1.35% to .85% may help the average borrower in Riverside County, CA save up to $1,500 a year and/or qualify for approximately $25,000 more!

Lower Monthly Payments: On an average $300,000 loan balance, a homeowner will save approximately $1,500 a year by reducing the monthly payment $125/month. This frees up more money for you to spend at Starbucks:-) Or invest wisely in your retirement….or pay for your higher Obamacare healthcare premiums.

Qualify for a Larger Loan: Because the monthly payment will be lower, this reduces a borrowers debt-to-income (DTI) ratio. Remember, how much a person qualifies for is a simple mathmathical equation…it’s not some random person deciding what they think you can or cannot afford, and all lenders have to comply with thye same FHA DTI ratio guidelines.

For example: if a borrowers maximum qualifying loan amount happens to be $300,000, the reduced MIP will now allow them to qualify for a $325,000 loan amount. That’s an 8% increase in buying power!

Who Will Benefit the Most From This?

Slashing the cost of FHA’s monthly mortgage insurance will help three groups of people by making homeownership more affordable.

1. Moderate Income / First Time Home Buyers (FTHB), Primarily the ‘Millenial’ Age Group. Historically, FTHB’s account for 40% of all home sales, but the last few years it dropped way down to 33%.

That’s a lot of 30 year olds living in mom and dads basement eating rice and noodles trying to save up for a home. This will also help buyers who are burdened by the repayment of student loan debt.

2. Boomerang Buyers who are Re-entering the Housing Market. Anyone and everyone who had to short sale, foreclosure and/or declared bankruptcy as a rsult of the Great Recession is pretty much beyond their waiting period and probably eligible to finance with FHA or even Conventional financing.

3. Current FHA Homeowners who Purchased the Last 1-5 Years. If a homeowner used FHA financing in the last 15 years, it will now be easier to qualify for an FHA Streamline refinance and meet the 5% net tangible benefit test.

But to be real honest, current homeowners should really consider refinancing out of their FHA loan and get rid of FHA MIP forever.

Will Reducing the Insurance Premium Help?

The Government thinks 800,000 FHA borrowers will take advantage of these lower MIP rates in the first year, saving millions of dollars and that lowered premiums will create opportunities for 250,000 new homeowners to purchase a home over the next three years.

My understanding is that people make the decision to purchase a home based on life events, such as a new job, employment, job security, an increase in pay, marriage, growing family etc…

And what about the lack of down payment being the biggest obstacle to people buying a home? How will lower MIP help them? There are many people who think people should not even be allowed to buy with just 3.5% down payment.

Will $125 savings trigger someone to rush out and buy a home using FHA financing? I doubt it.

We know for fact that lower mortgage rates do not cause people to buy homes right? We’ve had the lowest rates in history for the last 5 years and homeownership and volume of home sales by actual people (not investors), has plummeted.

In California, and many other parts of the country, FHA significantly reduced the FHA loan limits in 2014. I think restoring the FHA loan limits to 2013 levels would have more of a benefit than slashing the MIP.

For example: in Riverside County, CA the 2015 FHA loan limit is $355,350……it used to be %500,000. A first time entry level buyer or Boomerang Buyer can barely enter the market in that price range in most parts of Riverside County. As a result, demand and home appreciation come to a screaching halt for homes priced over $400,000.

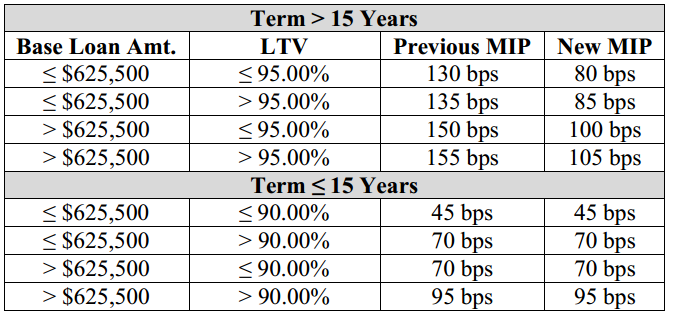

Revised Annual FHA Mortgage Insurance Premium

Alternatives to FHA Home Loans

If someone need a low down payment home loan to purchase, they should really consider qualifying for a Homebuyer Assistance Program that requires NO DOWN PAYMENT. In many cases, these programs can even be combined with a closing cost assistance program to pay some or all of the closing costs!

If you would like to better understand what programs are available and figure out which one is the best for you to purchase or refinance and get rid of your FHA PMI, CONTACT ME or call direct (951) 215-6119. I’m here to help.

No comments yet.