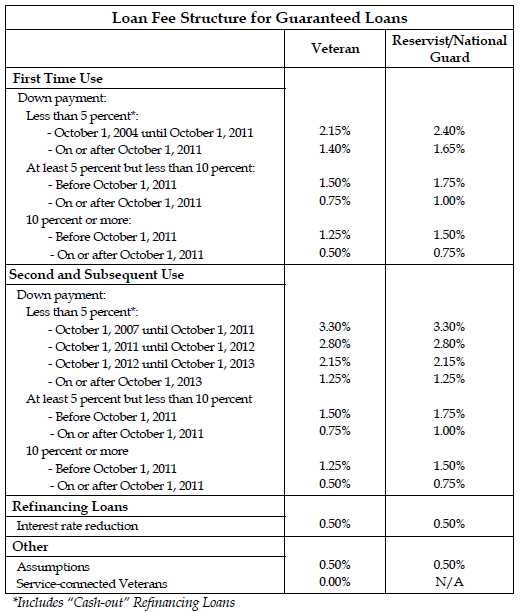

The VA home loan funding fee/costs for California Veterans (Active Duty, Reserves and National Guard too) is being reduced starting October 1st, 2011. Both first time and subsequent home buyers who qualify for a California VA home mortgage will benefit from the new Restoring GI Bill Fairness Act of 2011 that lowers the VA funding […]