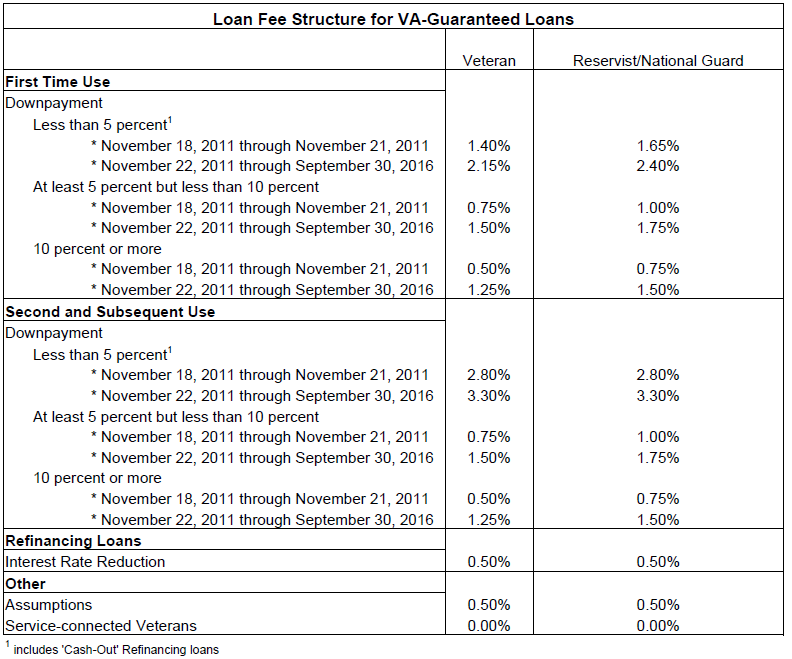

The VA Guaranteed loan funding fee has changed once again for Active Duty, Veterans, Reservists, and National Guardsman who are buying a home in California. In what could be one of the most confusing back and forth guideline changes since the housing crash of 2008, the Dept. of Veterans Affairs announced today that President Obama […]

Riverside County FHA Conforming/Jumbo Loan Limit 2012-2013 Restored!

The 2013 FHA conforming / jumbo loan limit in Riverside County, California was just extended back to $500,000. Many believe this action was critical in helping the Inland Empire housing market rebound to help more home buyers qualify for FHA’s low interest rate & low down payment mortgage programs. Contrary to what many people believe, […]

CA FHA Conforming / Jumbo Loan Limits Restored for 2012 – 2013

Congress agreed to restore, reinstate and extend the maximum jumbo & conforming FHA loan limits to $729,750 for 2013 after seeing the negative impact a loan limit reduction would have on certain high cost housing markets. Restoring the California 2013 FHA county loan limit was essential in stabilizing the housing market in many high cost […]

HARP Refinance For An Upside Down Mortgage in Corona-Chino-Riverside area

The new HARP government upside down/underwater mortgage refinance program will help some home owners in the Corona, Chino, Riverside, Canyon Lake, Moreno Valley, Lake Elsinore who want to keep their home and lower their interest rate and mortgage payment. What is HARP? It’s an instrument, but in this discussion we’re talking about the Home Affordable […]

How to Refinance An Up Side Down Mortgage in Temecula, Murrieta or Menifee

The new Home Affordable Refinance Program (HARP 2) just made it easier to refinance an upside down or underwater mortgage in Temecula, Murrieta or Menifee. The Federal Housing Finance Agency (FHFA) just announced October 24th there no longer is an LTV limit to refinance an upside down mortgage in Temecula, Murrieta, or Menifee. Prior to […]

Are Temecula and Murrieta Safe Cities To Live In Or Buy A Home?

Would you consider safety to be a major factor when deciding where to relocate or live when buying a home in California? For those of us familiar with, or already living in the Temecula and Murrieta Valley region of Riverside County, we sometimes forget how good this little part of the world really is. Business […]

A Divided Fed Reaches Comprise – Mortgage Rates Rise

Wednesday, the Federal Reserve released the minutes from its 2-day meeting September 20-21, 2011. The release shows a divided Fed in disagreement about the current U.S. monetary policy. The group reached compromise for new economic stimulus, however, and maintained its commitment to accommodative interest rates. Wall Street reacted tepidly to the minutes and mortgage rates in […]