The California mortgage rate market improved last week as Wall Street managed news on both sides of the economic coin. There were several instances of higher-than-expected inflation — an event that tends to lead rates higher — but weak domestic jobs data and a soft manufacturing report suppressed the damage. Rates were also held low […]

Corona, CA Mortgage Broker/Lender | Corona Home Mortgage Bank

Premier Capital Investments is a Corona, CA Mortgage Broker/Lender and Mortgage Bank offering Corona FHA, VA, USDA, HomePath, Conventional, and Corona Down Payment Assistance home loans. The flexibility of being both a bank and broker gives home buyers more loan options, ability to close faster, fewer qualifying restrictions, and a greater chance of qualifying for […]

Mortgage, Community Property State, and the Non-Purchasing Spouse: What You Need to Know

When applying for a government insured mortgage, like an FHA, VA, or USDA loan, home buyers in California are often shocked to hear their non-purchasing/non-borrowing spouse’s debts will count against them. Why are they shocked? Because they didn’t know about this in advance…..I know, that was too simple:-) The real shocking part comes when they […]

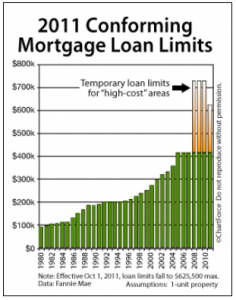

CA Conforming / FHA Loan Limits Dropping Oct. 1, 2011. How Will it Affect You?

If you are a home buyer or home owner in a traditional high-cost area of California, like Riverside, San Bernardino, San Diego, Orange, or Los Angeles county, October 1st could be a very bad day for you. Starting October 1, 2011, temporary conforming and FHA insurable loan limits will be lowered nationwide. ________________________________________________________ — UPDATE […]

What’s Ahead For California Mortgage Rates: June 6, 2011

Mortgage rates in California improved early last week as a result of worries about Eurozone sovereign debt default and the U.S. employment report showed the economy’s rebound to be moving slower than originally anticipated. In Greece, the nation readied itself for its second bailout in two years. The bailout measures from last year have not […]

Govt. to Increase FHA Down Payment & Costs Again? Should You Purchase Now?

With our elected officials proposal to increase the FHA down payment requirement to 5%, and FHA wanting to increase the monthly mortgage insurance premium to 1.5%, every prospective home buyer should be asking themselves is now a good time to buy and how would these increases affect me? Prospective home buyers often ask me […]

Home Sales: Looks Like Another Seller’s Market this Summer. What Does it Mean for You?

The National Association of REALTORS® Pending Home Sales Index rose for the third straight month last month.