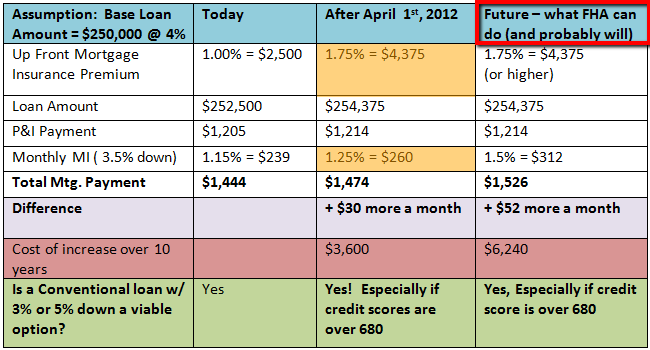

The Federal Housing Administration (FHA) announced they are increasing the cost of their Up Front Mortgage Insurance Premium (UFMIP) on FHA single family insured mortgage loans from 1.0% to 1.75%. FHA also announced the Annual (paid monthly) monthly insurance premium will increase from 1.15% to 1.25% for loans under $625,500 and up to 1.5% for loans over that amount.

The increase will add about $30/month to the payment for the average California Home buyer. Official FHAMortgagee Letter 12-4.

What is the Difference Between UFMIP and Annual (monthly) FHA Mortgage Insurance?

FHA loans have two types of mortgage insurance. The Up Front Mortgage Insurance Premium is a one time fee, now at 1.75% of the loan amount, that is paid directly to HUD/FHA. This 1.75% UFMIP fee is then added to the base loan amount. This increase is scheduled to take place April 9, 2012….no joking.

The FHA Annual Mortgage Insurance Premium is increasing from 1.15% to 1.25% for borrowers with loans under $625,500 and up to 1.45% for lhigh balance loan amounts between $625,500 and $729,500. The Annual insurance is collected monthly with your payment and taking effect April 9th, 2012, with the high balance increase beginning June 11, 2012.

This insurance is a guarantee to lenders that the mortgages it backs will be paid in case of default.

How Does the FHA Mortgage Insurance Increase Affect Me?

The chart below (for illustrative purposes only…..rates are actually lower today) shows how much your payment will increase starting April 1st, 2012 for a 30 year fixed loan with 3.5% down. Remember, FHA has been steadily raising their mortgage insurance fees over the last 3-4 years and we just react like a frog in boiling water. In 2011 I reported on how FHA raised the mortgage insurance fee in 2011 and wasn’t about to stop there.

Why Is FHA Making FHA Financing More Expensive?

- FHA’s Mutual Mortgage Insurance (MMI) fund is running below the mandated threshold due to default losses and payouts on insurance claims……homes that foreclosed and FHA paid the claim to the lender. They need to boost that balance. Since 2008, FHA has paid out $37 BILLION in claims to cover losses.

- FHA has mentioned many times they would like to decrease the number of loans they insure. By increasing mortgage insurance premiums, borrowers will look to other sources for home financing. Other sources? Yeah, I know, the only other source is the government owned/run/subsidized agencies of Fannie Mae and Freddie Mac. Fannie and Freddie are also trying to reduce the amount of loans they buy and securitize so they to are raising fees.

- It isn’t just FHA. Our fine upstanding congressman and congresswoman are taxing home buyers and home owners by charging taxes through FHA, Fannie Mae and Freddie Mac to fund the Temporary Payroll Tax Cut Continuation Act of 2011. Our govt. is literally nickel and diming us.

FHA Mortgage Insurance Increase and FHA Streamline Refinances

FHA announced a new lower cost FHA streamline refinance program for FHA loans endorsed before June, 2009. For those who qualify, the new FHA Streamline refinance will save a lot of money.

Is Conventional Financing now Less Expensive Than an FHA Mortgage?

If you have a 660 credit score or higher and either 3% or 5% down payment, you may want to seriously explore the difference between Conventional and FHA financing. There are differences in interest rate, mortgage insurance rates, credit and income DTI qualifying criteria, and other various guidelines differences.

Conventional financing allows you get more creative with Private Mortgage Insurance, such as Split Premium, Lender Paid, Borrower Paid monthly, and one time fee mortgage insurance.

Take action now to learn about your options or lock in a low rate FHA loan now before the FHA mortgage insurance premium increases. Contact me, email me brad(at)homeloanartist.com, or call direct (951) 215-6119.

Comments are closed.