The PreferredBuyer™ Advantage loan approval is the highest level of loan approval a home buyer can use when shopping for homes.

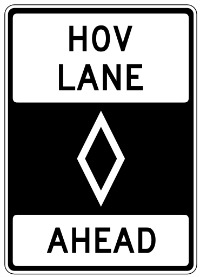

The PreferredBuyer™ Advantage for home buyers is like driving in the carpool fast lane during rush hour traffic…..you get to closing quicker, with less stress, and less risk of falling out of escrow.

The PreferredBuyer™ Advantage for home buyers is like driving in the carpool fast lane during rush hour traffic…..you get to closing quicker, with less stress, and less risk of falling out of escrow.

Surprisingly, most lenders DO NOT offer this level of approval, and even those who have are now abandoning issuing pre-approvals because they feel doing this for you is a waste of their time.

Read ==> three different types of home loan pre-approvals

Home buyers working with a more traditional/regular lender or broker will submit offers on homes using a worthless pre-qual or pre-approval letter and not realize they really aren’t approved.

Don’t settle for being ‘regular’…..that could cost you a lot of time, money, and emotional distress.

Pre-approval Letters are Worthless?

Most real estate agents agree that a typical pre-qualification or pre-approval letter isn’t worth the paper it’s written on. Why? Because the number of buyers who fall out of escrow due to their loan not receiving actual underwriter approval is alarmingly high!

In the Inland Empire, about 32% of all people who apply for a loan and are out making offers on homes (think they are ‘pre-approved’) are later denied at some stage of the escrow process.

Even more crazy is about 15% of these denials are wrongly denied! Wrongly denied means that another lender (like me) could have approved the loan.

Prequal Letters are Not a Commitment to Lend

Many LO’s just don’t have the experience to determine up front if your loan will approve….or they just don’t pay attention to the details or ask the right questions……or they don’t know the guidelines well enough to know what will approve and what won’t.

I know of loan officers who get more loan denials a month than loans I fund a month! They take a shotgun approach to pre-approving their customers where they nonchalantly issue as many prequals and pre-approval letters as they can in hopes that some of them stick….like throwing spaghetti (you) up against a wall.

This is often done with no regard to your financial interest and potential for losing your hard earned earnest money deposit while in escrow if your loan will not approve.

What is a PreferredBuyer™ Advantage Loan Approval?

A PreferredBuyer™ Advantage loan pre-approval is achieved by running **DU/LP/AUS and then submitting your entire loan application to underwriting prior to being in contract.

It’s a full review of your credit, income, and assets by the actual decision maker….the underwriter.

Benefits to Achieving a Preferred Buyer Loan Approval:

- Eliminates doubt that you, the buyer, are at risk of not qualifying. This brings peace of mind to both you and the seller

- Helps your loan close faster – often in 15-20 days

- Allows you to uncover and address any issues early in the home buying process

- Gives you leverage over other buyers

The PreferredBuyer™ Advantage Loan Pre-Approval Makes Life Easier for You.

If you offer $275,000 for a home with a PreferredBuyer™ Advantage™ pre-approval, and a competing buyer offer the same amount (or even more) with a regular prequal/pre-approval letter, who’s offer will they most likely accept? It’s a no brainer…..slam dunk….you have more leverage.

P.S. – Not all loan programs or buyers are eligible for a PreferredBuyer™ Advanatge Loan Approval……you need to call and find out.

P.S.S – A PreferredBuyer™ Advantage loan approval is still subject to final review and acceptable appraisal, title report, fully executed purchase contract, and satisfaction of any additional conditions. ** DU = Desktop Underwriter. LP = Loan Prospector. AUS = Automated Underwriting System. All three automated approvals are basically just software programs that read a borrowers credit report and income to give a preliminary approval. They are only as good or valid as the info that is input. They can sometimes give a false approval….so a DU/LP approval is almost worth the paper it’s written on.

Excerpt