The Mortgage Credit Certificate (MCC) program can make home ownership more affordable for California first time homebuyers.

The Mortgage Credit Certificate (MCC) program can make home ownership more affordable for California first time homebuyers.

What is a Mortgage Credit Certificate?

A Mortgage Credit Certificate gives qualified home buyers a dollar for dollar tax credit for part of the mortgage interest paid each year. It directly reduces a homeowners federal income tax liability.

Note: The Mortgage Interest Credit (MCC) is a non-refundable tax credit, therefore, the Homebuyer MUST have tax liability in order to take advantage of the tax credit. MCC facts.

Benefit of a Mortgage Credit Certificate

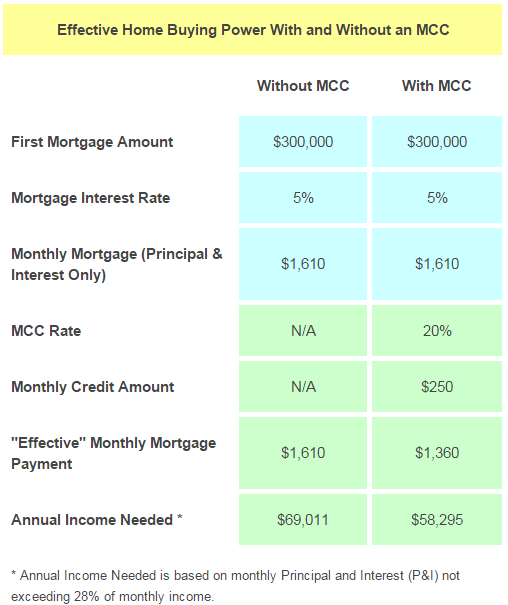

Other than the obvious benefit of saving you money by paying fewer tax dollars to Uncle Sam, the MCC can actually help borrowers qualify for a larger loan than when not using a Mortgage Credit Certificate.

It’s Not Magic, it’s Just Math

MCC tax credit savings can be real dollars applied to reduce your monthly PITI payment when using it with FHA financing to reduce the DTI ratio. The effective lower monthly house payment is what allows you to qualify for a more expensive home!

Conventional financing requires MCC tax credit be ADDED to a borrowers income.

VA financing requires the MCC tax credit be deducted from the VA’s residual income calculation.

==> Contact a participating MCC lender here and find out how much MORE an MCC can help you qualify for.

Example of How the MCC Increases Your Buying Power

(For example purposes only…not an actual estimate of current rates or payments)

MCC Eligibility

- Must be a first time homebuyer (not owned a home in last 3 years)

- Exceptions to this rule for those buying a home in a Federally designated area or you are a Qualified Veteran

- Cannot exceed the county income limits. Income limits can vary between which MCC provider is being used and whether you are buying in a federally ‘targeted’ area or non-targeted area.

- Primary residence owner occupied homes only

MCC Property Requirements

- Price of the home cannot exceed the county sales limit

- 5 acre maximum

- 1 unit SFR, PUD, Townhome, or Condo

- Home cannot have a guest house, “granny” unit, “in-law” quarters, and/or separate units containing kitchen facilities are not eligible

MCC Federal Designated ‘Target’ Areas

Like most other homebuyer assistance programs, MCC providers have federally designated target areas which make qualifying for the mortgage credit certificate easier. Learn about CalHFA Target areas here.

- Do not have to be a first time home buyer

- Have higher sales price limits

- Have higher income limits

The biggest challenge with buying in a targeted area is finding out where those areas are! If you would like assistance with your targeted area search, contact me.

Mortgage Credit Certificate Providers in California

Mortgage Credit Certificate programs are sponsored or offered by one of three entities:

- GSFA MCC (Golden State Finance Authority)

- County or City

The one downside of the MCC is that funds are often exhausted quickly. It’s important to check with me, your mortgage lender, to confirm MCC funds are still available and that you are eligible.

Important: not all MCC programs provide the same amount of tax credit. Contact me to determine which MCC program gives you the most benefit.

How to Apply for MCC

If you call me at (951) 215-6119 or contact me here , I will review your scenario and application to see if you are also eligible for one of the 289 home buyer assistance programs that are available throughout California and find the one that provides the most benefit to you.

[…] Interest Program (ZIP) can also be combined with the CHDAP 3% assistance program, the ECTP, and the MCC program as long as the combined-loan-to-value does not exceed 105%. However, layering assistance […]

[…] MCC Tax Credit can count as qualifying income […]