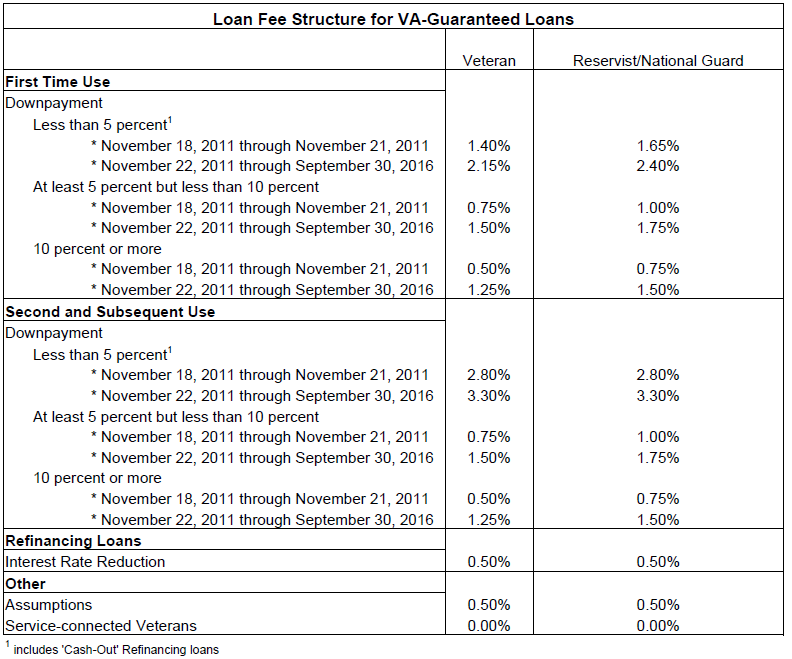

The VA Guaranteed loan funding fee has changed once again for Active Duty, Veterans, Reservists, and National Guardsman who are buying a home in California. In what could be one of the most confusing back and forth guideline changes since the housing crash of 2008, the Dept. of Veterans Affairs announced today that President Obama […]