If you are a home buyer or home owner in a traditional high-cost area of California, like Riverside, San Bernardino, San Diego, Orange, or Los Angeles county, October 1st could be a very bad day for you. Starting October 1, 2011, temporary conforming and FHA insurable loan limits will be lowered nationwide.

________________________________________________________

— UPDATE 12/10/2012 — Breaking News —– VA just reduced 2013 loan limits in California high cost counties

— UPDATE 11/17/2011 — Breaking News — congress just passed a bill to extend and restore the 2012 California FHA conforming Conventional loan limits and FHFA (Fannie Mae / Freddie Mac) just announced they would not change their loan limits for 2012.

________________________________________________________

HUD has also announced new (lowered) FHA insurable loan limits across the nation for 2011-2012. Looks like California has several counties that will be negatively affected and potentially impact home buyers who don’t have a large down payment saved up.

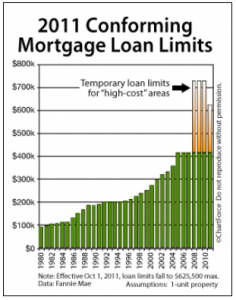

“Temporary loan limits” were enacted as part of the government’s 2008 economic stimulus package. At the time, the financial sector was entering its crisis and private mortgage lending had all but disappeared. Financing was scarce for both homeowners and home buyers for whom loan sizes exceeded Fannie Mae and Freddie Mac’s national $417,000 limit — even for those with excellent credit and income.

Riverside and San Bernardino will no longer be considered a high cost area in the eyes of Fannie Mae or Freddie Mac…this will impact you when buying a home in the mid $350,000 to mid $450,00 price range.

| County | New FHA loan Limit | New Conforming Limit |

| Riverside County | $355,350 | $417,000 |

| San Bernardino County | $355,350 | $417,000 |

| San Diego County | $546,250 | $546,250 |

| Orange County | $625,500 | $625,500 |

| Los Angeles County | $625,500 | $625,500 |

Conforming Loan Limits vary by property type (number of units). Call me for details (951) 215-6119. Get Pre-Approved Now The max conventional and FHA loan limits in Riverside and San Bernardino county is currently $500,000, but starting October 1st, 2011 through 2012, it will drop $144,650 for to $355,350, and for conventional loans during 2011-2012, it drops $83,000 back down to $417,000.

If you live in a high-cost area, or a former high cost area, mortgage rates may be low, but the amount of loan for which you qualify may be much less than you expect due to this change. After October 1, 2011 through 2012, you may find yourself ineligible to use a low down payment FHA loan to purchase your home, thus requiring you to come up with a HUGE down payment using a conventional loan.

Could this change or go back up in the future? Maybe….loan limits are evaluated yearly…..but I wouldn’t hold my breath.

Whether you’re planning to refinance or a purchase a home, keep an eye on the calendar and act sooner…..Call me at (951) 215-6119 or email: brad(at)homeloanartist(dot)com to get approved for your new home loan before it’s too late.

Very disappointing to see the government do this. This will hurt potential home buyers.

Hi Carmen. I agree, this move by the government will have an impact on the higher priced homes and people’s ability to secure financing.

Actually what this will really do is make homes more affordable for those who know the meaning of sacrifice, thrift and living within their means.

Yes, it may make homes more affordable for new buyers in the higher end price range…..but will possibly cause current home owners to lose equity in the higher priced homes. This could lead to more strategic defaults if those home owners feel the lower loan amounts will prevent buyers from being able to secure financing.