On March 27th President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act (HR 748) into law. The CARES Act provides mortgage forbearance relief to homeowners that have a federally backed mortgage who’ve been impacted by the COVID-19 pandemic.

On March 27th President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act (HR 748) into law. The CARES Act provides mortgage forbearance relief to homeowners that have a federally backed mortgage who’ve been impacted by the COVID-19 pandemic.

Skipping mortgage payments due to the COVID-19 Cornavirus national pandemic is a big decision, and should not be taken lightly. Before you consider entering into the Coronavirus forbearance program and skipping mortgage payments, please consider the unintended consequences and how that will impact you over the next 3, 6 or 12 months.

This article will help you understand what the COVID-19 forbearance plan is, how it works, who is eligible, alternatives to a forbearance plan, and provide answers to the most frequently asked questions that most people have.

What is the CARES Act Mortgage Forbearance Plan?

The Coronavirus COVID-19 CARES Act mortgage forbearance program is a short term relief plan (90 days) that temporarily suspends the customer’s mortgage payment in order to give homeowners time to recover and repay the missed mortgage payments.

The CARES Act mortgage relief has two key protections for homeowners:

- Forbearance for homeowners with a federally backed mortgage who are experiencing a financial hardship due to the Novel Coronavirus (COVID-19) pandemic

- Moratorium on Foreclosures & evictions for 60 days

Loan servicers have been instructed to provide mortgage relief options which include:

- Ensuring borrowers payment relief by providing forbearance for 90 days if they have a federally backed mortgage

- Waiving assessments of penalties or late fees

- Halting of foreclosures and evictions of borrowers living in homes owned by the mortgage servicer until at least May 17, 2020 (Freddie Mac)

- Suspending the reporting to credit bureaus of past due payments of those in a forbearance plan due to the COVID-19 emergency (but says nothing about it not being able to lower your credit score)

- Offering repayment plans and/or loan modifications for payment relief to keep mortgage payments the same after the forbearance period if a borrower is eligible and qualifies

- All property types are eligible, regardless if they are an investment, second home, or owner-occupied.

What is a federally backed mortgage?

A federally backed mortgage is a home loan owned, insured,guaranteed, or backed by:

– FHA

– VA

– USDA

– Fannie Mae

– Freddie Mac

With all of today’s stringent regulations that all lenders must comply with in terms of disclosure and 100% transparency, you should know what type of loan you have. If you don’t, or have forgotten, no worries, I got you.

FHA Loan ==> Look for an FHA case number on the mortgage document, specific language in the mortgage and note forms, or through the payment of an FHA premium on the mortgage statement.

VA Loan ==> A VA-guaranteed loan has specific language in the note identifying it as a VA loan, and there are fees paid to the VA noted in closing documents that would indicate if you have a VA loan.

What if You Don’t have a Federally Backed Mortgage?

About 30% of all mortgage loans are not backed by the federal government. If you don’t have a federally backed loan, you probably have what’s referred to as a non-QM (non-Qualified Mortgage).

This simply means your loan does not meet or conform to the federal government or the CFPB’s definition of a conforming or Qualified mortgage.

The best advice I can give you is to contact your servicer (the company you make your mortgage payment to) and discuss your circumstances and ask them about some options. They are not obligated to offer or comply with the federal CARES Act mortgage relief program.

When the Forbearance Plan is over

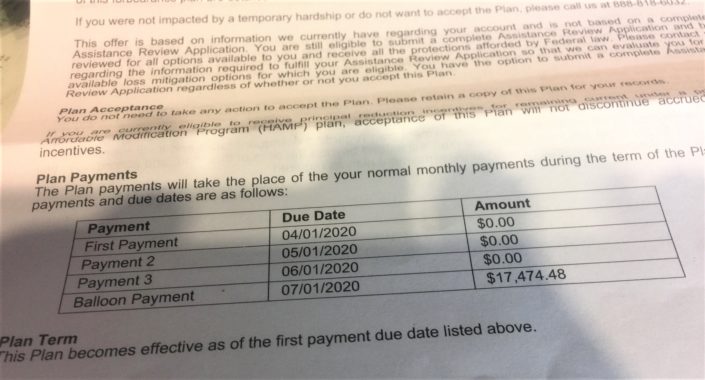

When your forbearance plan is over, you may be in for shock!

For example: if your monthly payment is $2,000/month and you enter into a CARES Act forbearance plan May 1st, for a period of 6 months, on November 1st you will owe $12,000, plus the November 1st payment….so a total of $14,000, on November 1st!!

Forbearance plans always have a ‘balloon’ payment where the borrower is expected to make a one time payment (lump sum) when the forbearance period is over in order to be reinstated as in good standing.

A forbearance is basically just kicking your problem down the road to one day potentially cause an even bigger problem for most people.

What if I Can’t Repay the Forbearance Amount?

If you are unable to pay your past due balance at the end of the forbearance period, there are six possible outcomes:

- Servicer Report Late Payments. The servicer may then begin reporting your late payments to the credit bureaus if you are unable to fulfill the terms of your forbearance agreement. This would destroy your hard earned credit score.

- Foreclosure. The bank can legally initiate foreclosure if you cannot fulfill the terms of your forbearance agreement! If you have equity in your home, there is a greater chance this will occur because banks would rather foreclose on a home with equity than one that has very little.

- Extended Forbearance Plan. You can request the bank approve you for an extension to your initial 90 day forbearance period, which is kicking the can further down the road, which could lead to an even bigger problem that will need to be addressed.

- Repayment Plan. You work out a plan to repay the past due amount. Based on your income and expenses, the lender may set up a plan for you to pay an additional $500 to $1,000+/month until your past due balance is repaid. Will you be prepared to pay that much more each month?

- Deferment Plan. This is where the lender may add the forbearance amount owed onto the end of the loan. The key here is you have to get approved for this option.

- Loan Modification. If you jump through multiple hoops and meet certain criteria that your banks requires, they may offer you a loan modification. A common loan modification plan will extend the term of the loan out to 40 or 50 years to reduce the monthly payment or they will reduce the payment for 1-4 years similar to how a negatively amortizing adjustable rate mortgage might defer interest and hit you with a much larger payment down the road. For most borrowers, a loan modification is just delaying the eventual foreclosure making losing their home even more painful and costly. Every loan modification I’ve ever seen was ALWAYS more beneficial to the mortgage bank, even in circumstances where they reduced the monthly payment.

Be careful when opting into a forbearance plan if you can’t make the balloon payment.

How to Qualify for an Extended Forbearance, Repayment Plan, or Loan Modification

Remember, the first 90 days of forbearance is guaranteed, no questions asked, but still requires a borrower contact their lenders loss mitigation department before skipping mortgage payments.

To extend that forbearance period, enter into a repayment plan, or qualify for a loan modification caused by the COVID-19 Coronavirus pandemic, it will take great effort and persistence on your behalf.

You will have to explain, demonstrate and document the cause for financial hardship, such as illness, job loss, furlough, income reduction, or other circumstances associated with the Coronavirus pandemic.

You should be aware that not all homeowners will be approved for a repayment plan or loan modification.

One of the best resources regarding the Coronavirus forbearance program can be found here at the the ForbereanceReport.com

Be Prepared to Explain & Document

- Fax in documents 2- 5 times because they constantly fail to receive or lose documents all the time

- Each time you fax in a document it may take 1-2 weeks for them to review

- Explain why you’re unable to make your payment or enter into a repayment plan

- Prove whether the problem is temporary or permanent

- Prove you are still furloughed, laid off, or pay is significantly reduced from before the COVID-19 crisis began

- Prove that your hardship is directly related to the COVID-19 pandemic

- Document your employment, income, expenses and other assets, like cash in the bank, retirement funds, etc..

- Document if you’re a service member with permanent change of station (PCS) orders or been activated to serve in your National Guard unit for additional benefits.

After all that effort on your part, if your servicer evaluates your financial situation and doesn’t feel your hardship warrants an extension to the initial 90 day forbearance, a reasonable repayment plan, or a reasonable loan modification, you will immediately have to bring your mortgage current with all past payments or else they will begin foreclosure proceedings.

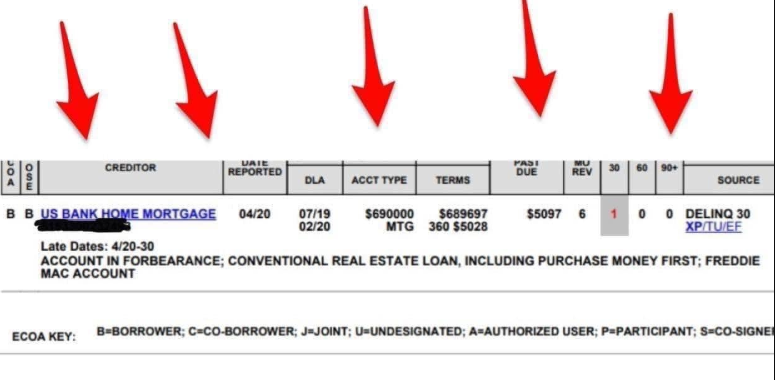

Will a Forbearance Plan Destroy My Credit Score?

No in theory, yes in reality.

The CARES Act gives direction to lenders and servicers to not report late payments when a borrower has entered into a forbearance plan. It says nothing about not reporting the account in forbearance, which will LOWER your credit score.

If lenders can’t report a late payment, what will they report?

It appears lenders are reporting a – (dash) in the place of where they would normally report the payment made or simply removing all payment history for the last 12 months. So it won’t report an actual 30-60-90-180+ day late payment and it doesn’t report that a payment was made either.

With no more payment history reporting for the last 12 months, borrowers lose out on that ‘on-time payment history and credit scores are going down!

Creditors are reporting a MOP code that indicates the mortgage is in forbearance and the word “FORBEARANCE” is clearly on the credit report. This is classified as a derogatory mark when it comes to generating a credit score.

We’re already starting to see just in the first month people who’ve entered into a forbearance plan having their payment history deleted for the last 12 months with the word “forbearance” reporting, and it lowering credit scores by 25-35 points!

Future credit or lending decisions you apply for, creditors will know you skipped making your mortgage payment when looking at your credit report history.

Mortgage lenders are reporting homeowners as being late AND in forbearance. This will lower your credit score 30-50 points AND likely prevent you from being able to refinance in the future.

Will a Forbearance Plan Prevent me from Being able to Refinance?

You definitely cannot refinance while in an active forbearance plan. The only way to get yourself out of forbearance is to pay any unpaid balance.

I think it will also impact your ability to refinance in the future, even after you are no longer in forbearance, because the automated desktop underwriting approval system will read the derogatory mark (forbearance).

Who Do I Contact to Set up a Loan Forbearance Plan?

Do not call or contact me. Contact your current mortgage servicer/lender. Log into your account online or call the phone number on your mortgage statement.

Only contact me if you are employed and want to refinance (or want to buy a home).

Alternative to a Coronavirus Forbearance Plan

If you have equity, can verify employment and income and have decent credit scores, you may want to avoid a forbearance plan and consider refinancing instead. Contact me here.

A refinance can help you experience the benefits that a short term forbearance plan will provide without it damaging your credit. A refinance will:

- Reduce your interest rate & payment

- Take cash out for emergencies, or consolidate high-interest credit card debt into a single low monthly payment

- Skip making 1 to 2 mortgage payments

- Refund of your escrow account balance

If you would like to inquire about how much you can reduce your interest rate and save by refinancing, complete this form here and I will work up and estimate for you.

No comments yet.