The California real estate and housing market has made a dramatic shift over the last 6-9 months. As a result, first time home buyers in California are experiencing more stress and becoming more worried about buying a home.

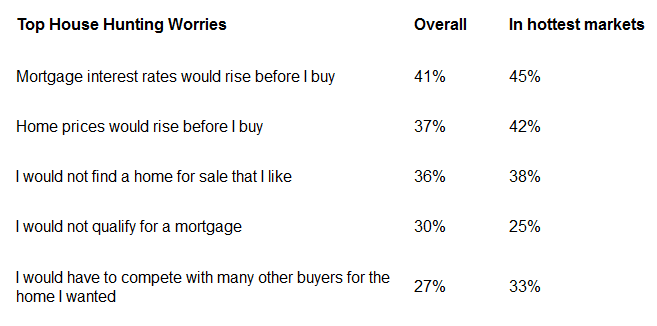

Harris Interactive and Trulia conducted a poll and found 7 concerns home buyers have when attempting to purchase in the 2013 real estate market that eventually lead to more aggressive home buying tactics.

It should be noted the 2013 real estate market in California is one of the hottest in the nation (see hot market column) with very low inventory, rapid home appreciation of 15-25%+ or more in many communities of S.W. Riverside County like Temecula, Murrieta, Corona, and Riverside, and rising mortgage rates.

How Worried Should Home Buyers be?

I don’t know about worried or anxiety ridden, but they should be concerned. Worry is typically a result of not feeling well informed or being unsure about the home buying process….that’s possibly more of a problem.

I do know that people who are confident with their home buying team (experienced local real estate agent and lenders),who have a buying strategy in place, and who have a Preferred Buyer Advantage Loan Approval, experience less worry and make better buying decisions.

Does Worry Lead to Aggressive or Desperate Home Buying Tactics?

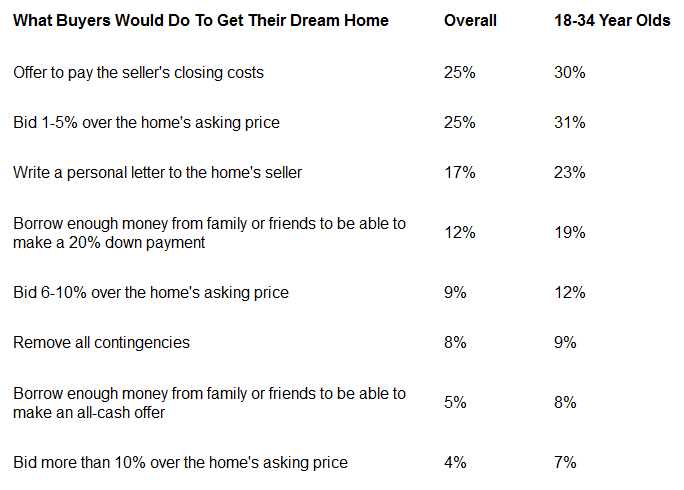

The Trulia survey revealed 66% of home buyers would use aggressive measures (see below) to buy a home. So yes, buyers who feel pressure to buy now out of fear of not being able to afford or qualify if prices and mortgages continue to rise are getting more aggressive.

They found buyers who make more than $100,000/year are more likely to offer to pay a sellers closing costs and buyers who make $50,000 or less are more likely to borrower money from family to come up with 20% down payment.

And yes, these tactics actually do work to help get an offer accepted.

Regardless of home prices and mortgage rates rising, people still realize that home ownership is still more affordable than renting, has many more benefits than renting, as well a a long term investment than will contribute to growing their net worth.

If you would like to discuss how I or one of the real estate partners i work with may be able to give you the inside edge in your home search, contact me at 951-215-6119.

Comments are closed.