FHA announced they may increase the FHA minimum down payment requirement on jumbo loans, increasing the annual (monthly paid) FHA mortgage insurance premium (MIP), changing qualifying guidelines to reduce how much a borrower qualifies for, and making the annual MIP FHA mortgage insurance premium PERMANENT for most borrowers.

UPDATE: ==> View current FHA mortgage insurance premiums here

FHA loans and FHA mortgage insurance, starting June 3rd, 2013, is becoming more like herpes….it’s painful and borrowers will have it for life!

FHA Commissioner Carol Galante initially sent a letter to Senator Bob Corker on December 18th outlining her intentions to reduce future defaults on FHA loans, restore the FHA’s Mutual Mortgage Insurance Fund, and shrink FHA’s involvement in helping people finance their home purchase.

FHA Commissioner Carol Galante initially sent a letter to Senator Bob Corker on December 18th outlining her intentions to reduce future defaults on FHA loans, restore the FHA’s Mutual Mortgage Insurance Fund, and shrink FHA’s involvement in helping people finance their home purchase.

You can read the final changes –> Mortgage Letters 2013-04 & 2013-05.

Essentially, Galante is making FHA financing more expensive and more difficult to qualify for in hopes that the private market (fun loving Wall Street investment bankers) will step up and start lending like they did back in the bad old days between 2002-2008 when alt-a/non-prime private lenders took advantage of borrowers with higher rate/fee loans that often had pre-payment penalties.

FHA/HUD wants private bankers to take on that risk while they build up their reserves. The problem is, private mortgage bankers aren’t stepping up to the plate……yet.

Summary of FHA Commissioner Galante’s Shocking FHA Mortgage Changes:

1. Manual Underwriting for 43% DTI Ratio and 620 Credit Score:

Applicants with FICO credit scores below 620 will be limited to having a 43% DTI ratio (debt-to-income). DTI is what determines how much a borrower qualifies for.

If the DTI is higher than 43% for a sub 620 credit score borrower, the lender can still approve the loan with a manual underwrite but must have compensating factors (larger down payment or reserves). Manual underwritten loans carry more risk to a lender and probably result in lenders not wanting to approve a DTI ratio loan over 43% with FICO scores under 620 FICO.

2. FHA’s Annual (paid monthly) Mortgage Insurance Premium is Permanent:

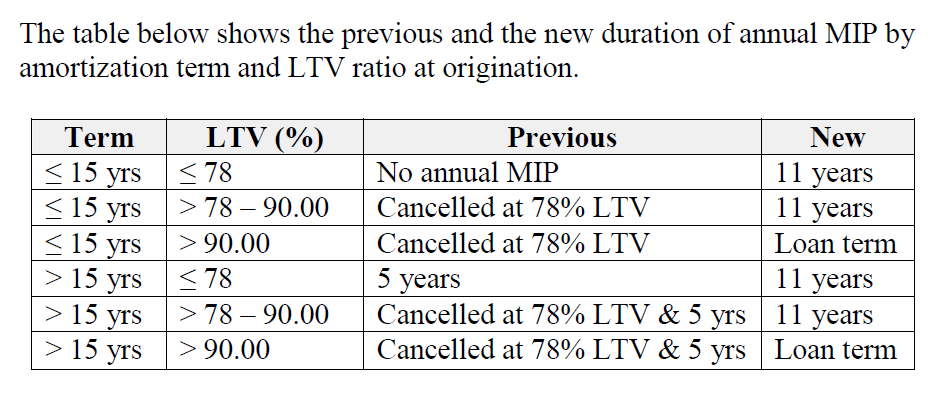

Until now, FHA borrowers could remove their monthly paid mortgage insurance when their LTV hit 78% or lower, but not sooner than 5 years. This is no longer the case when securing your loan after June 3, 2013.

How long a borrower must retain the annual MIP is dependent on the loan-to-value (LTV) and loan term at time of origination. For most FHA borrowers, the annual MIP will be permanent for the term of your loan (like herpes). Time to consider a 3% or 5% down payment Conventional loan program with NO monthly paid mortgage insurance.

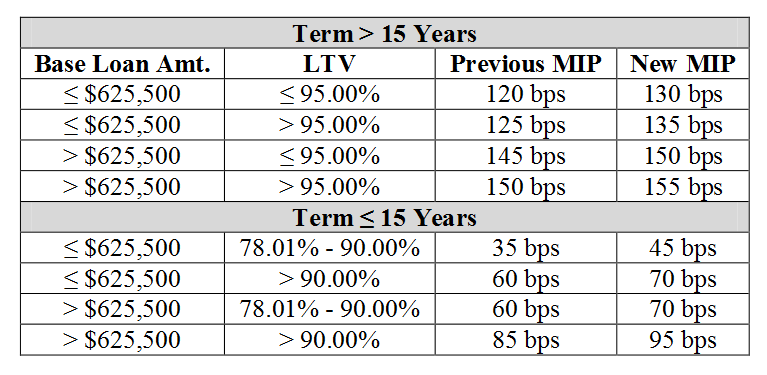

3. Increase of FHA Mortgage Insurance Premium:

FHA has been increasing both the Up Front Mortgage Insurance Premium (UFMIP) and the Annual (paid monthly) Mortgage Insurance (MIP) rate for the last 2-3 years to reduce replenish the dwindling MMI Fund. The increase in FHA’s MIP starts after April, 1, 2013.

4. Increase of FHA Minimum Down Payment to 5%:

FHA will probably be increasing the minimum down payment requirement to 5% for FHA jumbo/high balance loans between $625,500 and $729,000. Why? They think this reduces risk and will help reduce how many people consider FHA for financing their home purchase.

5. Access to FHA Loans To Buy Again After Foreclosure:

FHA wants to make it very clear that just because 3 years have passed before being able to qualify and buy again after your foreclosure. FHA wants lenders to stop implying with poor advertising that a borrower will qualify automatically and better document the reason for the foreclosure.

This could result in fewer lenders giving extenuating exceptions to buyer sooner after foreclosure, short sale, or bankruptcy.

What Do All These FHA Changes Mean?

What does this all mean? FHA wants more money! The writing is on the wall (again). I would take this as an indicator of even more changes coming later in 2013 or early 2014. It’s time to quit assuming FHA financing is the best option and really compare the pros & cons of FHA financing versus Conventional financing that only requires only 3-5% down payment.

Why do that? Because Conventional financing gives you the flexibility to buy out (eliminate) the Private Mortgage Insurance (PMI) premium so you have no monthly PMI payment and the monthly borrower paid PMI rates are lower than what FHA offers.

Any Changes to FHA Streamlines?

If your FHA loan was endorsed before May 31, 2009 you will be grandfathered in and not be required to take the higher MIP rate. Your MIP rate will be .55. If you secured your loan after May 31, 2009, and want to reduce your rate and payment with our FHA Streamline refinance program, you have until April 1st, 2013 before FHA enforces their much higher MIP rate upon you.

This higher MIP rate eliminates most of the benefit of refinancing into a lower interest rate would now be permanent….not to mention being less likely to meet the 5% net tangible benefit test. So hurry up!

How Much Can You Qualify for Now?

People who were pre-approved just one year ago may not qualify for the same amount today due to FHA raising their insurance premium. If you want to find out how much you qualify for, secure a Preferred Buyer Advantage Loan Approval, and/or compare differences in payment between FHA or Conventional financing, contact me here or call me direct (951) 215-6119.

_________________________________________________

Credit goes to Dan Green for bringing this Corker letter and changes to my awareness.

Comments are closed.