What is a MyCommunity Mortgage?

The MyCommunity Mortgage® is a Fannie Mae 3% down payment affordable lending program that gives borrowers access to flexible underwriting guidelines and reduced private mortgage insurance (PMI) coverage for moderate income home buyers in California.

The MyCommunity loan program has some subtle differences in qualifying criteria between the 3% down (97% LTV) option or the 5% down (95% LTV) option.

Many mortgage banks don’t offer the 97% LTV MCM program and even fewer loan originators take the time to educate or compare the MCM loan, the Conventional 97, FHA, or the Home Possible Advantage program as options when inquiring about mortgage programs.

MyCommunity Guidelines & Highlights

MyCommunity Guidelines & Highlights

- 30 year fixed

- Primary Residence only – Purchase or Refinance

- Max loan amount of $417,000

- 640 Minimum Credit Scores (or what DU approves)

- FTHB education class is required

- Max 97% LTV for qualified first time home buyers

- Purchase only

- 97% LTV requires at least one borrower be a FTHB’r

- Max CLTV of 105% with a Community 2nd mtg.

- Max 95% LTV for non-first time home buyers

- Cannot own other property

- Purchase or R&T refinance

- Maximum DTI ratios 45% or whatever DU allows

- No minimum borrower contribution

- Gift funds allowed (from family, employer, Community 2nd’s)

- Non-occupied co-borrowers not allowed

- Borrower income cannot exceed 140% of the AMI in California (see below)

- Up to 49% of qualifying income can come from an occupying co-borrower who has insufficient credit history

My Community Income Limits

Southern California County Income Limits

- Riverside County – $84,980

- San Bernardino County – $84,980

- Orange County – $91,980

- San Diego County – $101,780

- Los Angeles County – $91,980

- Ventura County – $124,180

- San Louis Obispo – $107,800

- Kern County – $72,380

- Contact me for other counties.

==> All household income (borrower/non-borrower) is considered when calculating AMI limits.

MyCommunity VS. FHA

Seven reasons why the MyCommunity Mortgage can be a better option than FHA or traditional financing:

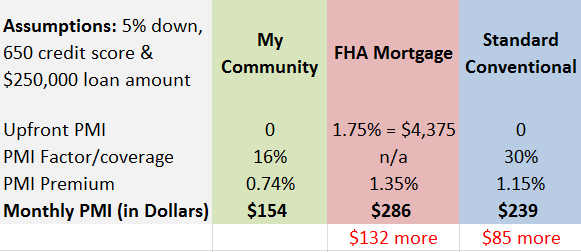

- The MCM PMI is often less than FHA’s MIP

- MCM doesn’t require up front mortgage insurance

- MCM doesn’t require a Condo approval like FHA requires

- The PMI on a MCM can be removed when reaching 80% LTV…FHA’s MIP is permanent

- MCM allows border income to be used for qualifing

- MCM allows **Unsourced cash to be used for the down payment

- MYM allows co-borrowers with little to no credit history to count their income for qualifying!

Compare PMI Savings vs FHA vs Conventional

$0 Down Payment Needed when Combined with CHDAP

$0 Down Payment Needed when Combined with CHDAP

The MyCommunity Mortgage loan program allows the CalHFA CHDAP 3% down payment/closing cost assistance program to be combined with it to satisfy the 3% down payment requirement or to be used to pay closing costs. CHDAP may have lower qualifying income limits so be sure to check that as well (call me).

My Community also works with the CHF Platinum assistance program.

==> Get Educated & Take Action <==

If you want a mortgage lender who is going to be transparent and lay out ALL of your mortgage options rather than railroad you into the 1-2 loan programs they are familiar with, contact me here or call (951) 215-6119.

P.S. Never heard of the MCM program? You may be eligible for 100% financing or other affordable home buyer assistance programs that other lenders or real estate agents are not telling you about.

No comments yet.