Most homebuyers are not aware that disputing a tradeline account on your FICO credit report can actually get your home loan denied or delay the closing.

In an attempt to improve or repair a credit score when preparing to finance a home purchase or refinance, many homebuyers hire ‘credit repair’ companies who will dispute all derogatory accounts, even the legitimate ones, hoping that the creditor will not respond or validate the debt with-in 30 days.

Just because you can dispute an account on your credit report doesn’t mean you always should.

If creditors don’t respond to the dispute with-in 30 days, the credit bureaus, (Experian, Transunion, and Equifax) are required to drop these accounts from the consumers credit file…..which may raise he consumer’s FICO credit score.

It amazes me that so many industry professionals are still not aware that Fannie Mae, Freddie Mac, FHA, the VA, and USDA have updated their qualifying guidelines requiring disputed credit accounts be removed or updated to report as ‘resolved’.

What’s Wrong With Disputing Incorrect or Derogatory Credit?

What’s Wrong With Disputing Incorrect or Derogatory Credit?

There is nothing actually wrong with disputing your credit tradelines, but if you are planning to finance a home, there are two major problems that affect mortgage qualifying that will arise.

- When a mortgage lender runs the borrowers loan application through an automated software loan approval system that has disputed collection, charge-offs, or other accounts with a history of late payments, the accounts are not included in the credit risk assessment. This will often give a ‘false positive’ approval.

- Disputed tradelines will artificially and temporarily increase a borrowers credit scores because the FICO credit scoring algorithm does not include the payment history or debt related measurements in the score. This is what most credit repair gurus rely on to trick you into thinking they are increasing your credit score…..they try to ‘game’ the FICO scoring system.

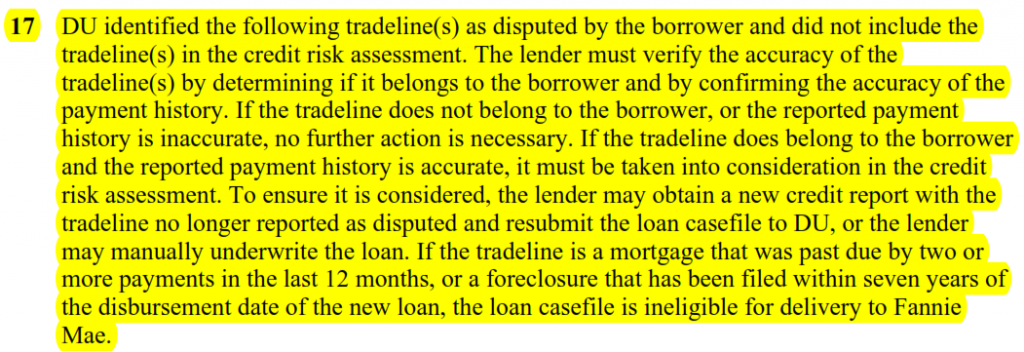

Fannie Mae Guideline on Disputed Tradelines

When Desktop Underwriter issues a message stating that DU identified a disputed tradeline and that tradeline was not included in the credit risk assessment, lenders must ensure the disputed tradelines are considered in the credit risk assessment by either obtaining a new credit report with the tradeline no longer reported as disputed and resubmitting the loan casefile to DU, or manually underwriting the loan.

If DU does not issue the disputed tradeline message, the lender is not required to investigate or obtain an updated report.

Special Note: the lender is required to ensure that the payment for the tradeline, if any, is included in the debt-to-income ratio if the account does belong to the borrower.

Once the dispute is removed or resolved at the bureau level, the credit report must be re-run and the automated re-run to see if it still approves.

Below is an actual borrowers DU finding report that had credit disputes.

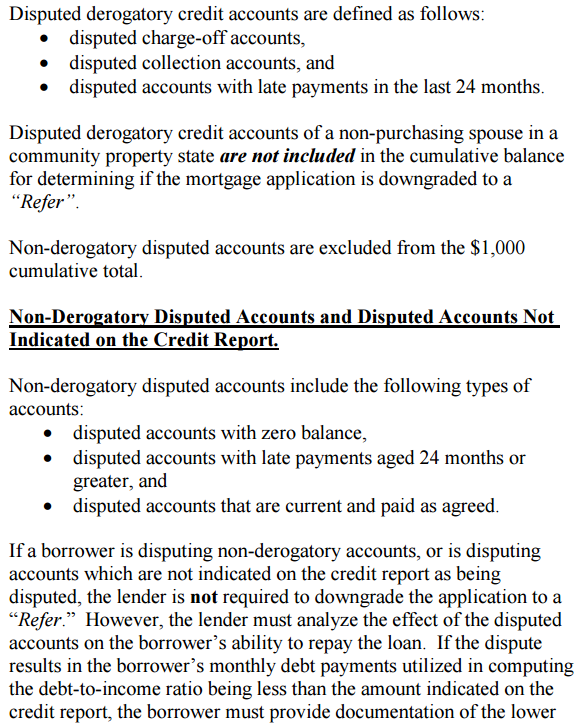

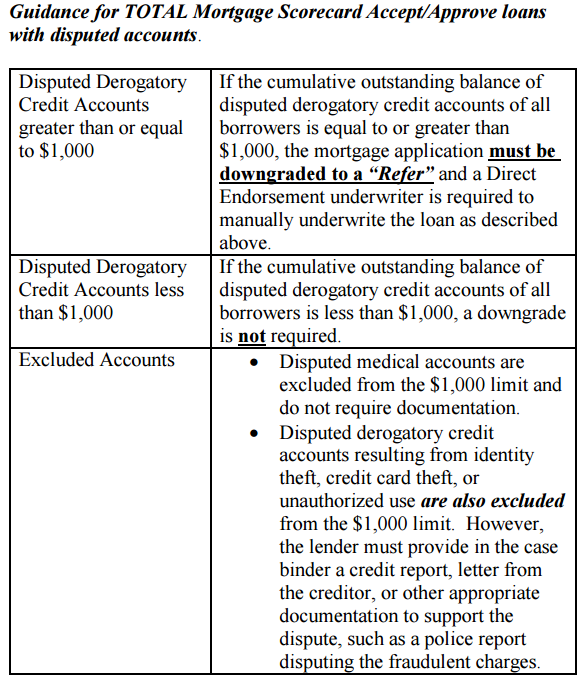

FHA and USDA Guideline on Disputed Tradelines

Disputed accounts on the borrower’s credit report are not considered in the credit score utilized by TOTAL Mortgage Scorecard in rating the application. Therefore, FHA and USDA requires the lender to consider them in the underwriting analysis as described below.

VA loans and Disputed Tradelines

VA loans and Disputed Tradelines

The VA doesn’t have any official published guidelines regarding the handling of disputed accounts but lenders will typically follow the FHA published guidelines.

Manual Underwrites and Disputed Tradelines

If you are unable to remove the disputed status or unable to get the creditor to report it as resolved, Fannie Mae and FHA will not accept an automated approval and down grade it to a manual underwrite. So what, big deal, right? Bring on the manual underwrite!

Most lenders will not do a manual underwrite on Conventional or USDA loans.

For FHA and VA Manually underwritten loans, a whole different set of qualifying criteria will come into play.

- Manual underwrites often limit DTI ratios’ to 41% or 43%. This can significantly reduce how much you qualify for.

- Manual underwrites will often require a verification of rent with canceled checks to prove rent was paid on time.

- Manual underwrites can take longer.

Delays Cost You Money & Stress

If the borrower cannot meet the manual underwriting criteria needed for a loan approval, it will often take 2+ weeks to get the disputed tradelines to report as resolved. This will often cause you to miss your closing date and the seller can take your hard earned earnest money deposit for failing to perform on the sales contract.

If you are preparing to get pre-approved, you need to know the difference between a pre-qualification and a pre-approval. It would be wise to work with a mortgage lender (like me) who knows what to look for BEFORE you enter into contract and get tripped up by something as trivial as this.

I know the guidelines and I’m proactive so you can avoid obstacles that can jeopardize your earnest money deposit and cause a lot of undue stress trying to fix.

I can be reached at (951) 215-6119 or contact me here to discuss how a PreferredBuyer™ Advantage loan pre-approval will benefit you.

Brad,

I just read your article. We are trying to fix this right now. I have 4 items on my credit report listed as open disputes from 6 years ago. 2 old student loans that were paid off and two old credit cards. I disputed for like a stupid 30 date late charge on one of them.

I tried calling Transunion to clear one of them on the phone and they couldn’t even locate it.

I got the partial account number wrong – it was from that account number I had back in 0006 not the one on the partial report the loan guy cut and paste in an email to me to fix.

Looks like from your article I need to contact the folks and see if we can get it listed as resolved ASAP.

Any advice for me to knock this out quick? You know the drill, underwater mortgage family guy can save over $450 on a 2 loan house that is underwater by doing the first loan at 4.5 instead of 6.25 but the snafu hits and the wife says hey take care of this asap.

Tim

All mine have zero balances.

All of mine have zero balances that are a problem, anything I can do in my favor. I am dealing with Quicken on a Freddy.

Tim,

What you need to do is start a dispute/resolution directly with Equifax, Transunion, and Experian online. Just tell them you no longer dispute the info on the credit report and to please report as resolved. This should take 15-30 days to get back to a resolved status once requesting.