FHA announced a reduction of .25% in their annual Mortgage Insurance Premium (MIP) for all FHA loans beginning January 27, 2017. The FHA’s ‘annual’ MIP is actually paid on a monthly basis by the FHA borrower.

More details can be found here FHA Mortgagee Letter 2017-01 and FAQ’s here.

——- SUSPENDED INDEFINITELY ——-

In a shocking announcement, President Trump has directed new HUD Secretary Ben Carson to suspend the reduction of FHA’s annual Mortgage Insurance Premium (MIP) that President Obama had directed just 2 weeks ago on January 9th.

You can read details of the Mortgagee Letter 2017-07 here

_______________

The FHA (Federal Housing Administration) believes the premium cut “will significantly expand” access to mortgage credit and lower the cost of housing for approximately 1 million households who are expected to purchase a home or refinance their mortgages using FHA-insured financing in 2017.

In California, this .25% reduction in mortgage insurance premium is projected to save the average new FHA insured borrower $875/year!

FHA’s one time Up Front Mortgage Insurance Premium (UFMIP) will remain unchanged at 1.75%.

Is Reducing the FHA MIP Good Timing?

The Federal Housing Administration’s (FHA) reduction in their annual mortgage insurance premium couldn’t have come at a better time.

Since FHA announced they would not reduce their mortgage insurance premium, mortgage rates spiked .5% higher since President Trump won the election. So FHA’s lower MIP will help offset the higher rates and keep payments lower to make home ownership more affordable.

The last time FHA cut their mortgage insurance premium was back in January of 2015 when it dropped from 1.35% to .85%.

Lower Payments or Increased Buying Power

The lower FHA monthly mortgage insurance premium accomplishes 2 things.

- Streamline Refinance or Purchase = Lower payments and Savings: On a $350,000 loan balance, the lower MIP will reduce the payment by about $72/month.

- Increases buying power and qualify for larger loan: If a buyers maximum loan amount they qualify for is $350,000, they will now qualify for about $10,000 more with the lower MIP.

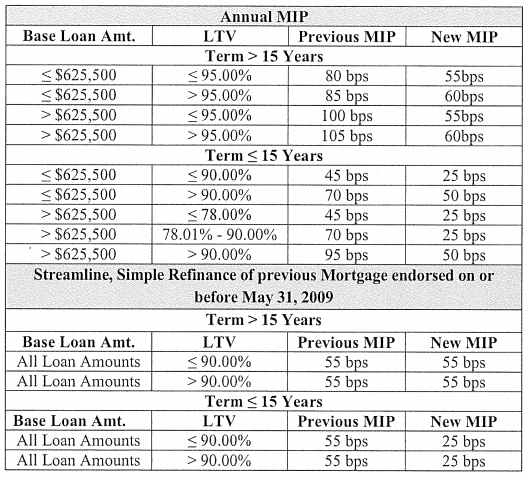

2017 FHA Annual Mortgage Insurance Premium Chart

FHA Mortgage Insurance Premium Historical Chart

| Date of Change | Monthly MI | Upfront MIP |

| Before January 2008 | .50% | 1.50% |

| October 2008 | .55% | 1.75% |

| April 2010 | .55% | 2.25% |

| October 2010 | .90% | 1.00% |

| April 2011 | 1.15% | 1.00% |

| April 2012 | 1.25% | 1.75% |

| April 2013 | 1.35% | 1.75% |

| January 2015 | .85% | 1.75% |

| January 2017 | .60% | 1.75% |

Alternatives to FHA Financing

FHA financing is typically suited for borrowers who have credit scores between 580 to 680.

For borrowers with credit score over 680 who don’t like the thought of paying FHA’s mortgage insurance premium for the life of the loan, or want to avoid paying the costly 1.75% UFMIP, then you should consider alternatives to FHA financing.

Conventional financing (Fannie Mae & Freddie Mac) offers four different low down payment programs you can learn more about here:

==> 3% down HomeReady Mortgage

==> 3% down HomePossible Advantage

==> 1% Down Conventional Loan Program

==> 3% down Conventional loan

Get the Facts & Be an Informed Homebuyer

Take time to learn about all your loan and/or homebuyer assistance options to find out which one will benefit you the most by a loan officer who specializes in and embraces these specialty loan programs.

Contact me here or call direct (951) 215-6119 for more details. I lend in all 58 counties throughout California.

Related Articles of Interest:

No comments yet.