What is the HomePossible Advantage Mortgage Program?

The HomePossible Advantage Mortgage Program (HPA) is a new 3% down payment (97% LTV) Freddie Mac Conventional mortgage program designed to make homeownership more accessible and affordable for credit worthy borrowers throughout California who have a limited down payment savings and moderate incomes.

The Home Possible Advantage home loan is an affordable loan option when buying or refinancing a home in California because it offers reduced PMI coverage levels (lower payments), reasonable underwriting criteria, and no minimum borrower contribution requirements.

Borrower Beware ==> many lenders do not offer this program and even fewer Loan Officers/Originators are aware that it even exists. Odds are that most lenders will not present this option to finance their home, which is unfortunate.

==> Pre-qualify for the HomePossible Advantage & compare options

Home Possible Advantage Guidelines & Highlights

- 15, 20 & 30 year fixed loan term

- Minimum credit score of 640

- Do NOT have to be a First Time Home Buyer but cannot have ownership in other properties

- Primary residence only – SFR/Condo ( 1 unit only)

- Maximum 97% LTV and 105% TLTV

- No minimum contribution – 100% gift OK

- No minimum reserves required

- Reduced PMI

- 85-97% LTV = 25% MI coverage

- 80-85% LTV = 12% MI coverage

- DTI ratio – determined by Loan Prospector findings

- Refinance – rate & term only

- Homeownership education (Credit Smart) is required when both borrowers are first time buyers

- MCC Tax Credit can count as qualifying income

Home Possible Advantage Income Limits

Southern California Income Limits 140% of the area median income (AMI) limit.

Income limits are not based on the county, but rather by census tract and address. You would be surprised at how many census tracts in areas you may consider ‘wealthy’ areas have no income limit or the income cap is much higher than you would expect.

Income Limit in Underserved Areas – The Home Possible Advantage program has NO INCOME LIMIT when buying in an ‘underserved area‘. Not sure what an underserved census tract area is? Contact me.

IMPORTANT ==> Only income from the borrower(s) on the loan count towards meeting the income limit/cap. Income from a spouse who is not on the loan does not count when determining program eligibility and income cap limit.

Home Possible Advantage vs. Other Programs

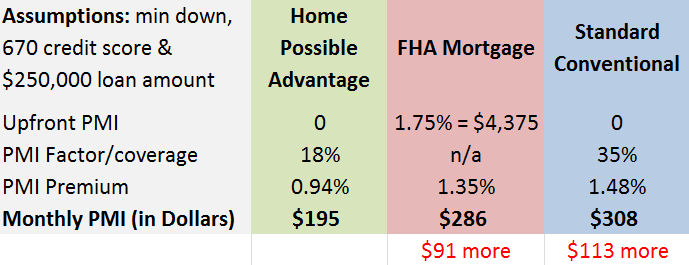

Here are five reasons why the Home Possible Advantage (HPA) mortgage can be a better option than FHA or traditional Conventional financing:

- The HPA PMI coverage is often less than FHA’s annual MIP

- HPA doesn’t charge up front mortgage insurance like FHA

- The PMI can be removed/canceled on the HPA loan when reaching 80% LTV (FHA’s MIP is permanent)

- Fewer loan level price adjustments to help keep rate lower.

- **Unsourced cash can be used for the down payment

- Co-borrowers who have little to no credit history can use their income for qualifying!

This is just for example purposes and is not an actual estimate.

Read Freddie Mac’s has answers to Frequently Asked Questions here.

==> Compare All Your Options & Take Action <==

If you want a mortgage lender who is going to be transparent and lay out ALL of your mortgage options rather than steer you into the 1-2 loan programs they are most familiar with or understand, contact me here or call (951) 215-6119.

Related Articles of Interest:

No comments yet.